If an Online Marketplace (OMP) has ‘facilitated’ an import sale not exceeding £135, it is responsible for charging and reporting Sales Tax VAT.

(The 1 January 2021 UK B2C e-commerce and marketplace reforms - NOTE Imports are handled by Import customs over £135.00. Numismatic items are 5% Import VAT + handling charges).

(Well known examples of OMP are - eBay, Amazon and others)

PROBLEM - One OMP, namely eBay is charging a flat rate of 20% on Numismatic items and many other goods such as books which are EXEMPT, WHY?

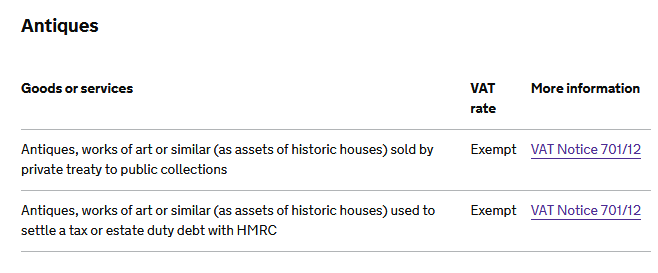

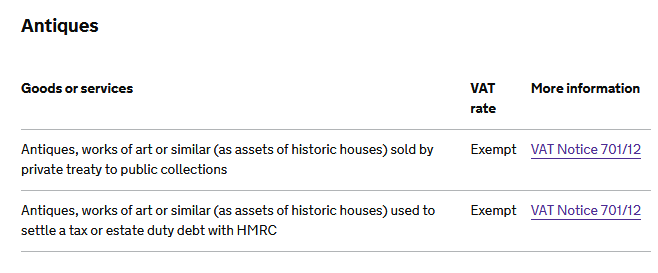

HMRC - A list of goods and services showing which rates of VAT apply and which items are exempt or outside the scope of VAT.

Screenshot and link below:-

https://www.gov.uk/guidance/vat-on-antiques-or-art-from-historic-houses-notice-70112

NEXT:-

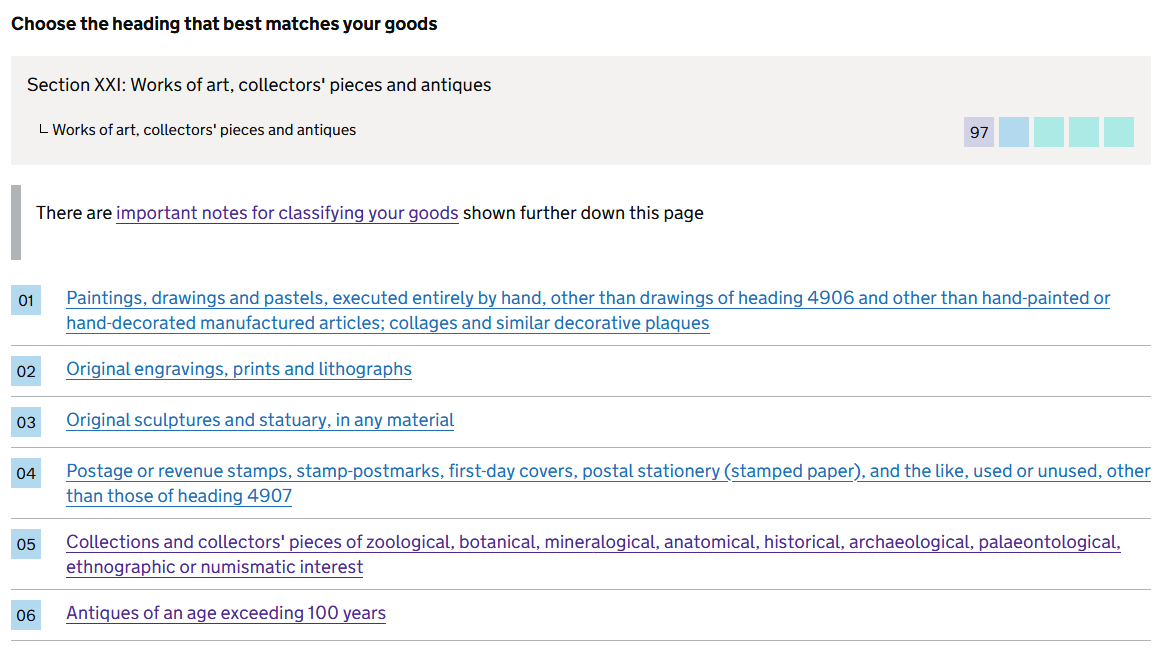

HMRC - Definition of Antiques, works of art, screenshot and link below:-

https://www.trade-tariff.service.gov.uk/chapters/97

See also:- https://www.gov.uk/guidance/vat-on-antiques-or-art-from-historic-houses-notice-70112

So clearly Sales Tax VAT on Numismatic items in the UK is Exempt. However, the VAT will be paid by a VAT-registered seller through their VAT returns.

Margin Scheme for second-hand goods, works of art, antiques and collectors’ items, or the Global Accounting Scheme or VAT Auctioneers’ Scheme to account for VAT on your sale of goods.

Some of these schemes, notably - Margin Scheme for second-hand goods, works of art, antiques and collectors’ items fall foul of the rules with OMP Sales Tax VAT purchases!

Screenshot below from;- https://www.gov.uk/guidance/the-margin-and-global-accounting-scheme-vat-notice-718#para20-1

NOTE THE SHADED AREA!

c.png)

Most Numismatic dealers are, I think, on The Margin Scheme and if they are charged 20% more for non (Sales Tax) VATable coins, they simply will not be able to make a profit!

Also if they sell to The EU via an OMP (Online Marketplace) from July 2021 when The EU will be using OMP system, what will happen then - same thing?

THIS SYSTEM IS JUST INCORRECT

Here is why. A coin purchsed on an OMP site £135 and below is unfair.

Is Sale Tax VAT applicable to Numismatics? I say not, EXEMPT GOODS for Sales Tax VAT

Via OMP (below £135 (eBay) - £134 is now £160 (20% Sales Tax VAT) - Can not claim the Sales Tax VAT if you are on the Margin Scheme VAT registered.

NOW COSTS £160, SAME AS COLLECTOR'S PAY.

Via Customs Import (above 135.00) - £135.01 is now £141.76 (5% Import VAT) + handling charge circa £12.00 (A recent charge I have experienced on an Australian import) = £153.76 - Can usually claim Import VAT and handling as part of the VAT return.

NOW COSTS £135.01 or very close, COLLECTOR'S will pay £153.76.

IF OVERCHARGED BY EBAY If you're a UK consumer and you want to request a VAT refund, you can use - upload supporting documentation.

If any of the above information is incorrect please advise, because I am not a tax expert. However if you are unsure please contact your tax adviser.