!! IMPORTANT NOTICE to OUR EU FRIENDS !!

You are probably thinking that you will be paying 17 to 25%

(dependent on EU member state) on coins (Numismatic/Collector's items) imported from the UK due to IMPORT VAT

This is NOT TRUE

READ ON - IT IS A MUST!

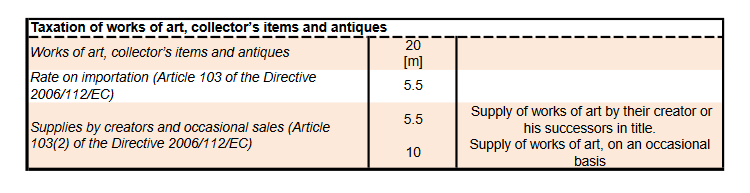

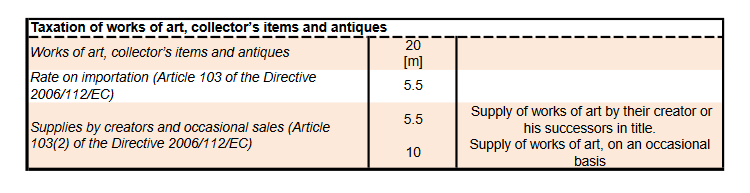

I have done quite a lot of looking/digging into this. Here are the rates of import duty on Numismatic items - List of a few import VAT rates applied in the Member States (in %)

Belgium 6%, Germany 7% (Confirmed by German Tax Adviser), Ireland 13.5%, Spain 10%, France 5.5%, Italy 10%, Luxembourg 8%, Netherlands 9%,

Austria 13%, Poland 8%, Portugal 6%, Sweden 12% (Some territories may be different, such as The Island of Corsica for example).

Here is the link to the EU 's official information on these facts:-

https://taxation-customs.ec.europa.eu/system/files/2020-10/vat_rates_en.pdf

Then scroll down to your EU member state listing and check out Taxation of works of art, collector's items and antiques - Rate on importation.

Above is a sreenshot of France VAT percentages. You will see Collector's items, rate on importation is clearly 5.5%.

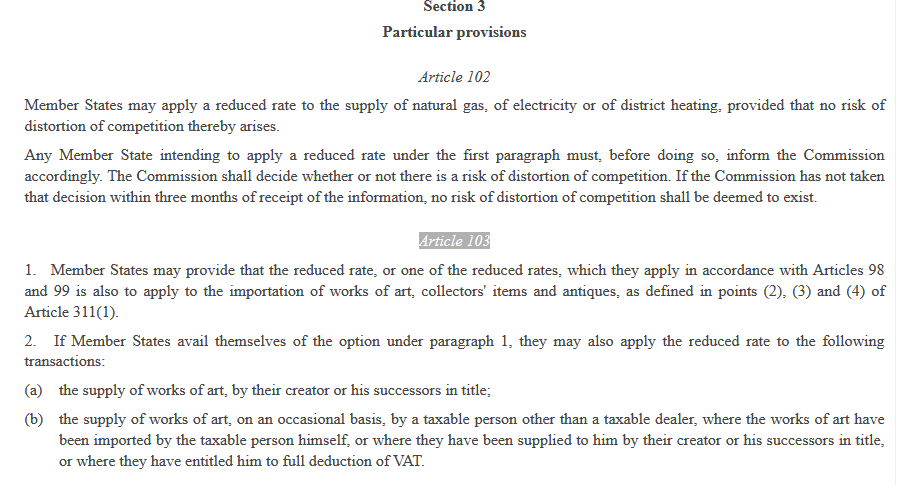

FOLLOWING IS PROOF OF THE REDUCED VAT RATES ON NUMISMATIC IMPORTS INTO THE EU

Now for Article 103 of the Directive 2006/112/EC which is

See in below Screenshots:-

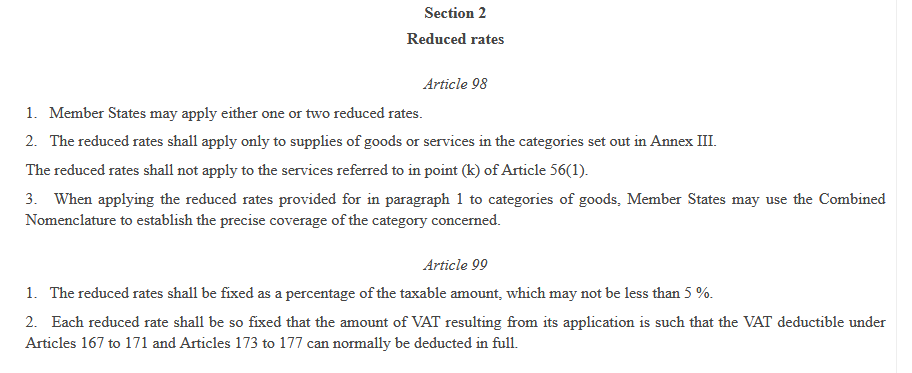

Now for Article 98 and 99 of the Directive 2006/112/EC

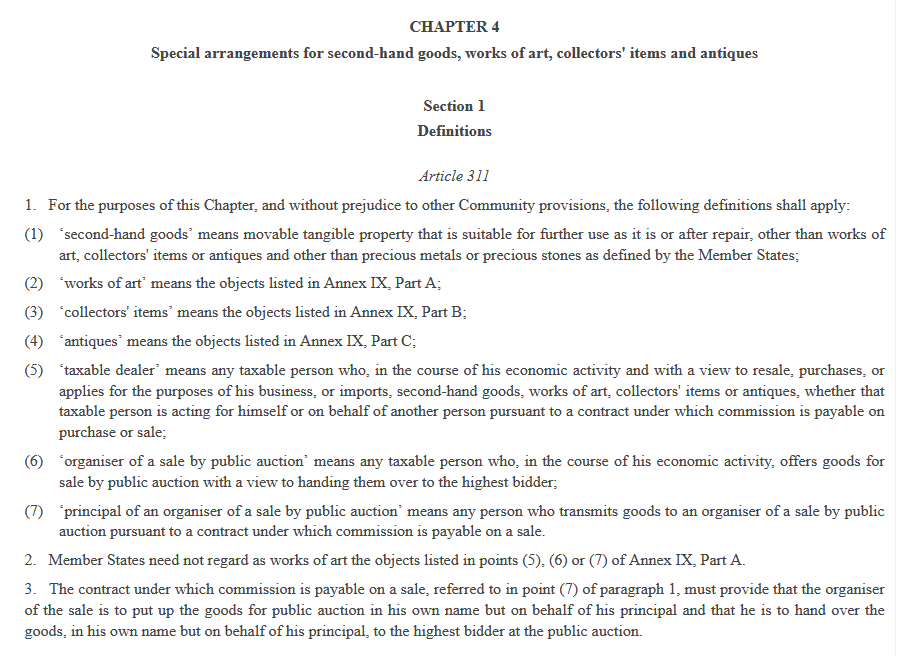

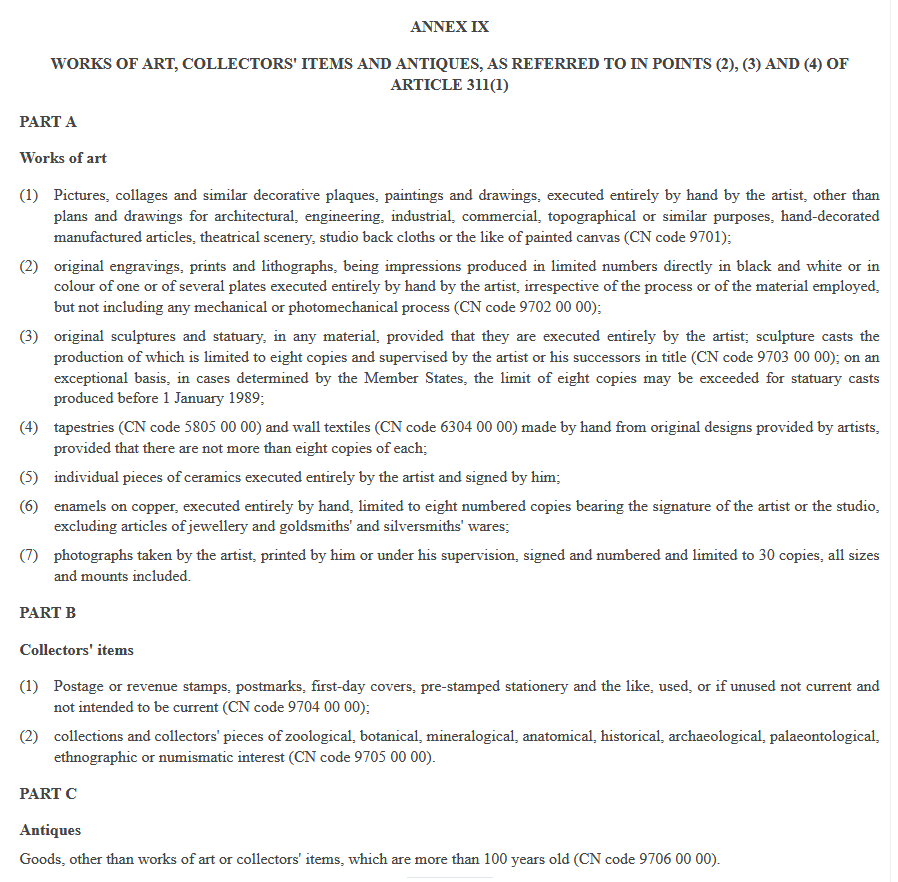

Now for Article 311(1) of the Directive 2006/112/EC

You may have noticed Annex IX, Part B of the Directive 2006/112/EC - so I have screenshot that as well.

So in other words the special arrangments for import VAT on numismatic items imported into EU member states are at a reduced rate VAT(R)!

Please note that there will be other charges such as Import Duty, Import VAT and Handling Fees however to date we have not had Import Duty only Import VAT and Handling Fees.

------------------------

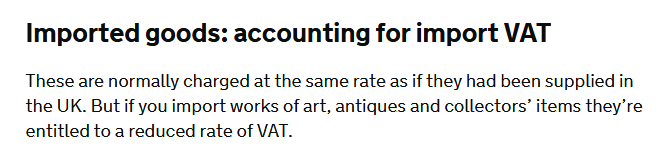

NOW FOR IMPORTING INTO THE UK FROM THE EU

Please note numismatics are under the Commodity Code (CN number) 9705 00 00 for importing into the UK. This CN number is VATR (R = Reduced rate). In the UK it is at 5% import VAT reduced rate.

Here is the gov.uk link to prove that this is the case in the UK https://www.gov.uk/guidance/vat-imports-acquisitions-and-purchases-from-abroad#imported-goods-accounting-for-import-vat

See in below Screenshot:-

In the UK there are three rates - Normally VAT at 20%, Reduced at 5% and of course Zero-rated VAT,

so 5% VAT(R) import to UK it is.

If any of the above information is incorrect please advise, because I am not a tax expert. However if you are unsure please contact your tax adviser.